We are here to help you with exploring protection

We are here to help you with exploring protection

OUR MISSION

OUR VISION

ABOUT US

OVERVIEW

Get A Free Quote - Life Insurance

To help you achieve your financial goals at different stages of your life, Hantec has designed a range of insurance policies for each of the seven stages of your life, so that you can better understand what you need to protect at different times.

LIFE PLAN MAP

Product Recommendations

In recent years, the incidence of critical illnesses such as cancer, stroke and heart disease has been increasing and is becoming more prevalent at a younger age. Fortunately, with the rapid advances in medical technology, many critical illnesses can be cured with early detection and treatment. However, the problem is that the cost of advanced drugs or new treatments is very high and not affordable for everyone.

Critical illness insurance allows you to have sufficient funds to back you up against illnesses with peace of mind. Once the insured is diagnosed with a designated covered disease, you can receive a lump sum cash benefit to cover medical expenses without delaying treatment due to fear of expensive medical expenses.

During treatment, if you lose your stable income because you are temporarily unable to work, this compensation can also help you cover the cost of living, temporarily relieve your immediate needs, and let your stable life not be affected.

At present, many critical illness insurance plans on the market have multiple critical illness protection, providing more than one critical illness compensation. Once the critical illness unfortunately recurs, you can also get relevant compensation and financial support again.

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Savings insurance allows you to build wealth and enjoy complete protection for years to come. You can save for your children's education or as a stable source of income for your future retirement. Combined with life insurance, you can achieve your goals sooner rather than later, and provide peace of mind for you and your loved ones.

Savings insurance plans generally offer a guaranteed cash value and, in some cases, a non-guaranteed element. You can build more wealth faster and give you more opportunities to achieve your financial goals by taking out savings insurance while you are still young.

In addition, savings insurance also includes a life protection component. In case the insured person dies unfortunately, the policy will provide a death benefit, allowing his family to receive immediate financial support and have greater protection in his future life.

HANTEC offers a wide range of savings insurance policies that can help you to build up your capital and provide you and your family with long-term protection for a secure future.

Product Recommendations

In recent years, the incidence of critical illnesses such as cancer, stroke and heart disease has been increasing and is becoming more prevalent at a younger age. Fortunately, with the rapid advances in medical technology, many critical illnesses can be cured with early detection and treatment. However, the problem is that the cost of advanced drugs or new treatments is very high and not affordable for everyone.

Critical illness insurance allows you to have sufficient funds to back you up against illnesses with peace of mind. Once the insured is diagnosed with a designated covered disease, you can receive a lump sum cash benefit to cover medical expenses without delaying treatment due to fear of expensive medical expenses.

During treatment, if you lose your stable income because you are temporarily unable to work, this compensation can also help you cover the cost of living, temporarily relieve your immediate needs, and let your stable life not be affected.

At present, many critical illness insurance plans on the market have multiple critical illness protection, providing more than one critical illness compensation. Once the critical illness unfortunately recurs, you can also get relevant compensation and financial support again.

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Savings insurance allows you to build wealth and enjoy complete protection for years to come. You can save for your children's education or as a stable source of income for your future retirement. Combined with life insurance, you can achieve your goals sooner rather than later, and provide peace of mind for you and your loved ones.

Savings insurance plans generally offer a guaranteed cash value and, in some cases, a non-guaranteed element. You can build more wealth faster and give you more opportunities to achieve your financial goals by taking out savings insurance while you are still young.

In addition, savings insurance also includes a life protection component. In case the insured person dies unfortunately, the policy will provide a death benefit, allowing his family to receive immediate financial support and have greater protection in his future life.

HANTEC offers a wide range of savings insurance policies that can help you to build up your capital and provide you and your family with long-term protection for a secure future.

Provide children's education savings insurance plans for novice parents of different families, helping you grow your savings and build a stable financial situation.

Product Recommendations

Savings insurance allows you to build wealth and enjoy complete protection for years to come. You can save for your children's education or as a stable source of income for your future retirement. Combined with life insurance, you can achieve your goals sooner rather than later, and provide peace of mind for you and your loved ones.

Savings insurance plans generally offer a guaranteed cash value and, in some cases, a non-guaranteed element. You can build more wealth faster and give you more opportunities to achieve your financial goals by taking out savings insurance while you are still young.

In addition, savings insurance also includes a life protection component. In case the insured person dies unfortunately, the policy will provide a death benefit, allowing his family to receive immediate financial support and have greater protection in his future life.

HANTEC offers a wide range of savings insurance policies that can help you to build up your capital and provide you and your family with long-term protection for a secure future.

In recent years, the incidence of critical illnesses such as cancer, stroke and heart disease has been increasing and is becoming more prevalent at a younger age. Fortunately, with the rapid advances in medical technology, many critical illnesses can be cured with early detection and treatment. However, the problem is that the cost of advanced drugs or new treatments is very high and not affordable for everyone.

Critical illness insurance allows you to have sufficient funds to back you up against illnesses with peace of mind. Once the insured is diagnosed with a designated covered disease, you can receive a lump sum cash benefit to cover medical expenses without delaying treatment due to fear of expensive medical expenses.

During treatment, if you lose your stable income because you are temporarily unable to work, this compensation can also help you cover the cost of living, temporarily relieve your immediate needs, and let your stable life not be affected.

At present, many critical illness insurance plans on the market have multiple critical illness protection, providing more than one critical illness compensation. Once the critical illness unfortunately recurs, you can also get relevant compensation and financial support again.

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Product Recommendations

Savings insurance allows you to build wealth and enjoy complete protection for years to come. You can save for your children's education or as a stable source of income for your future retirement. Combined with life insurance, you can achieve your goals sooner rather than later, and provide peace of mind for you and your loved ones.

Savings insurance plans generally offer a guaranteed cash value and, in some cases, a non-guaranteed element. You can build more wealth faster and give you more opportunities to achieve your financial goals by taking out savings insurance while you are still young.

In addition, savings insurance also includes a life protection component. In case the insured person dies unfortunately, the policy will provide a death benefit, allowing his family to receive immediate financial support and have greater protection in his future life.

HANTEC offers a wide range of savings insurance policies that can help you to build up your capital and provide you and your family with long-term protection for a secure future.

In recent years, the incidence of critical illnesses such as cancer, stroke and heart disease has been increasing and is becoming more prevalent at a younger age. Fortunately, with the rapid advances in medical technology, many critical illnesses can be cured with early detection and treatment. However, the problem is that the cost of advanced drugs or new treatments is very high and not affordable for everyone.

Critical illness insurance allows you to have sufficient funds to back you up against illnesses with peace of mind. Once the insured is diagnosed with a designated covered disease, you can receive a lump sum cash benefit to cover medical expenses without delaying treatment due to fear of expensive medical expenses.

During treatment, if you lose your stable income because you are temporarily unable to work, this compensation can also help you cover the cost of living, temporarily relieve your immediate needs, and let your stable life not be affected.

At present, many critical illness insurance plans on the market have multiple critical illness protection, providing more than one critical illness compensation. Once the critical illness unfortunately recurs, you can also get relevant compensation and financial support again.

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Life insurance, which provides financial protection for your family or dependents in the event of death. Life insurance can provide lump sum or periodic benefits. If you are the breadwinner of your family, you should consider the need to purchase life insurance. Life insurance is also an essential arrangement if you have debts (such as a mortgage) that must be paid after your death.

Product Recommendations

Provide a substantial and secure source of income for your future retirement. There are two types of annuities: immediate annuities, which can be withdrawn as soon as the premium is paid in a lump sum; and deferred annuities, which can be withdrawn at the beginning of a specified income period after the lump sum or premium payment period has expired.

Savings insurance allows you to build wealth and enjoy complete protection for years to come. You can save for your children's education or as a stable source of income for your future retirement. Combined with life insurance, you can achieve your goals sooner rather than later, and provide peace of mind for you and your loved ones.

Savings insurance plans generally offer a guaranteed cash value and, in some cases, a non-guaranteed element. You can build more wealth faster and give you more opportunities to achieve your financial goals by taking out savings insurance while you are still young.

In addition, savings insurance also includes a life protection component. In case the insured person dies unfortunately, the policy will provide a death benefit, allowing his family to receive immediate financial support and have greater protection in his future life.

HANTEC offers a wide range of savings insurance policies that can help you to build up your capital and provide you and your family with long-term protection for a secure future.

In recent years, the incidence of critical illnesses such as cancer, stroke and heart disease has been increasing and is becoming more prevalent at a younger age. Fortunately, with the rapid advances in medical technology, many critical illnesses can be cured with early detection and treatment. However, the problem is that the cost of advanced drugs or new treatments is very high and not affordable for everyone.

Critical illness insurance allows you to have sufficient funds to back you up against illnesses with peace of mind. Once the insured is diagnosed with a designated covered disease, you can receive a lump sum cash benefit to cover medical expenses without delaying treatment due to fear of expensive medical expenses.

During treatment, if you lose your stable income because you are temporarily unable to work, this compensation can also help you cover the cost of living, temporarily relieve your immediate needs, and let your stable life not be affected.

At present, many critical illness insurance plans on the market have multiple critical illness protection, providing more than one critical illness compensation. Once the critical illness unfortunately recurs, you can also get relevant compensation and financial support again.

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Life insurance, which provides financial protection for your family or dependents in the event of death. Life insurance can provide lump sum or periodic benefits. If you are the breadwinner of your family, you should consider the need to purchase life insurance. Life insurance is also an essential arrangement if you have debts (such as a mortgage) that must be paid after your death.

Product Recommendations

Provide a substantial and secure source of income for your future retirement. There are two types of annuities: immediate annuities, which can be withdrawn as soon as the premium is paid in a lump sum; and deferred annuities, which can be withdrawn at the beginning of a specified income period after the lump sum or premium payment period has expired.

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Life insurance, which provides financial protection for your family or dependents in the event of death. Life insurance can provide lump sum or periodic benefits. If you are the breadwinner of your family, you should consider the need to purchase life insurance. Life insurance is also an essential arrangement if you have debts (such as a mortgage) that must be paid after your death.

Heritage Savings is a participating life insurance. Through guaranteed cash value, non-guaranteed reversionary bonus and non-guaranteed terminal bonus, we help clients achieve potentially considerable long-term wealth growth.

Heritage Savings also provides multiple options for flexible financial arrangements to help customers accumulate wealth and at the same time help to properly arrange wealth inheritance planning in advance, so that customers can benefit future generations with wealth. In addition to unlimited replacement of the insured when necessary, a variety of death benefit payment options, policy split options and continuation options are set up to enhance the flexibility of wealth inheritance.

Universal life insurance - An insurance solution with flexible savings features. Through this financial plan, customers can not only earn interest, but also can use funds flexibly by withdrawing part of the funds to prepare for their future life and easily meet their ideal life.

Product Recommendations

Are you overwhelmed by the sudden medical expenses? Medical insurance not only provides comprehensive and reimbursable medical insurance including hospitalization, surgery, medicines and other related medical service costs, but also provides high-quality medical networks and specialist support, allowing you to control your budget and medical needs with peace of mind.

With the limited supply of beds in public hospitals in Hong Kong, many people who are ill or injured and need to be hospitalised would prefer to be admitted to a private hospital where the waiting time is shorter and where they can enjoy better medical services and more choices. However, the private sector charges high fees and when you and your family need to be admitted to hospital, you may be worried about whether you can afford the medical expenses.

HANTEC offers a comprehensive medical insurance plan to help you and your family share the cost of medical treatment so that patients can focus on treatment and early recovery.

Our medical insurance also provides a cash protection plan for hospitalization, which provides a fixed amount of cash compensation for the number of days of hospitalization, and provides you with additional financial support to make up for the loss of income suffered during illness or hospitalization, so as to avoid affecting the normal life of you and your family.

Heritage Savings is a participating life insurance. Through guaranteed cash value, non-guaranteed reversionary bonus and non-guaranteed terminal bonus, we help clients achieve potentially considerable long-term wealth growth.

Heritage Savings also provides multiple options for flexible financial arrangements to help customers accumulate wealth and at the same time help to properly arrange wealth inheritance planning in advance, so that customers can benefit future generations with wealth. In addition to unlimited replacement of the insured when necessary, a variety of death benefit payment options, policy split options and continuation options are set up to enhance the flexibility of wealth inheritance.

Universal life insurance - An insurance solution with flexible savings features. Through this financial plan, customers can not only earn interest, but also can use funds flexibly by withdrawing part of the funds to prepare for their future life and easily meet their ideal life.

Get A Free Quote - Corporate Insurance

Hantec provides specialists to provide corporate clients consultation, quotation, claims services, etc.

Corporate Insurance

Product Recommendations

Office Package Insurance

Comprehensive Protection - Protects office property, including equipment, pallets, inventory and employees' personal belongings, and the owner's or tenant's installations and equipment, providing full coverage and new replacement protection. However, the insured must insure the above property at its new replacement value.

Business interruption protection - computer failure, damage or loss of systems and records caused by mechanical or electrical failure

Losses from robbery

Money Protection - Protects the company against monetary losses in Hong Kong (including loss of cash, crossed cheques, credit card receipts and other non-negotiable instruments, and safe deposit boxes damaged by thieves)

Public Liability Protection - Covers the legal liability for bodily injury or property damage to a third party caused by negligence or error in the course of business operations within the insured location.

Employees Compensation Insurance - Protects employers from compensation and legal liabilities arising from work-related injuries or deaths of employees.

Public Liability Insurance

Applicable to shops, building management, construction decoration, factories and offices, etc.

Enterprises may be liable for high compensation for personal injury or property loss to third parties due to negligence in operations.

Public liability insurance can protect companies from the legal liabilities arising from the above risks.

Group Travel Insurance

Coverage includes accidental injury, medical and hospitalization expenses, personal liability, loss of luggage and cash, flight delays and theft of property.

Frequently Travel for business or pleasure, you can choose year-round travel protection to save the trouble of purchasing travel insurance every time.

Professional Indemnity Insurance - As a professional, no matter how careful you are, it is difficult to completely avoid the risks associated with the expectations of your customers and the public. Crisis always strikes unexpectedly, and the gap in expectations often turns into allegations or even lawsuits related to negligent behavior, misrepresentation or poor service.

Professional liability insurance role

- Reduce the impact of litigation costs on cash flow

- Avoid large compensation lawsuits that threaten the company's survival

- Enhance the company's reputation and strengthen customer confidence in Overseas contract requirements, and gaining new customers.

- Reduce losses caused by unreasonable litigation

D & O Insurance - Protect directors and management from financial risks arising from wrong decisions, negligence, breach of business or listing rules, etc. when overseeing listed or unlisted companies, including investigations by regulatory authorities and related legal liabilities.

Key points of protection

- Defense costs, legal representation fees, damages, judgments, settlements, bail bonds, crisis management fees, asset stripping fees

- Fees, litigation costs, public relations costs, and costs incurred in extradition proceedings

- The insured person is required to bear the company's unpaid taxes and civil fines as a result of the company's bankruptcy

Motor - Insurance - It covers the loss of the vehicle itself due to accidental collision, fire, theft and malicious acts, as well as the legal liability compensation for personal injury and property damage to third parties. According to Chapter 27 of the Motor Vehicle Insurance (Third Party Risks) Ordinance, all car owners must purchase third party insurance for their vehicles.

Comprehensive

In addition to third party insurance, the protection also covers losses to the insured vehicle itself.

Third Party Insurance

Protects against legal liability compensation for personal injury, death or property damage to third parties caused by negligence or fault in the use of the vehicle.

Contractors’ All Risks Insurance - It covers the risks of various accidents faced by the contract works during the contract period. It can also be supplemented with third party liability insurance to protect the insured from legal liability compensation for physical or property losses caused to third parties due to negligence or mistakes.

• Employee Compensation Insurance can also be added to protect employees from medical expenses, funeral expenses, etc. caused by work-related injuries, partial or complete permanent loss of work ability, or death during the construction period

Property Insurance - Protect your industrial, commercial or office equipment from accidental loss or damage

Machinery and equipment, like your other valuable assets, should be properly maintained and protected at all times. This is because they are more susceptible to accidental loss or damage, requiring high costs to repair or replace the equipment.

Property damage insurance protects you against unexpected and sudden loss or damage to all your machinery and equipment.

Cyber Insurance

Third Party Protection

The loss or disclosure of customer or employee data could result in large claims. Our third party protection covers you against possible claims for damages, defence costs, fines and penalties resulting from a breach of data protection regulations.

Business interruption protection

Our cyber protection provides coverage for lost revenue during business interruptions.

Repair cost protection

Covers your costs incurred as a result of a data breach, such as IT forensic investigations, credit monitoring, public relations and cyber extortion costs.

Internet Fraud Protection

Cybercrime is becoming increasingly sophisticated, and plans protect you from social engineering, phishing, hacking, cyber fraud and any other fraudulent incidents.

Get A Free Quote - Employee Benefits

Your Trusted Partner

Hantec provides specialists to provide corporate clients consultation, quotation, claims services, etc.

Employee Benefits

Product Recommendations

Employee Benefit

Help clients develop innovative solutions to improve their ability to recruit and retain valuable employees. Regardless of the company, employees are the key factor in determining whether the business can be stable and successful. Therefore, it is very important to make the employee benefit plan competitive in the market and valued by employees.

- Employee Benefit Plans Design

- Administrative strategy and technology

- Group Medical Plan Design

- Portable medical Plan

- Employee Communication

Get A Free Quote - Voluntary Employee Benefits Program

Your Trusted Partner

Hantec provides specialists to provide corporate clients consultation, quotation, claims services, etc.

Voluntary Employee Benefits Program

Product Recommendations

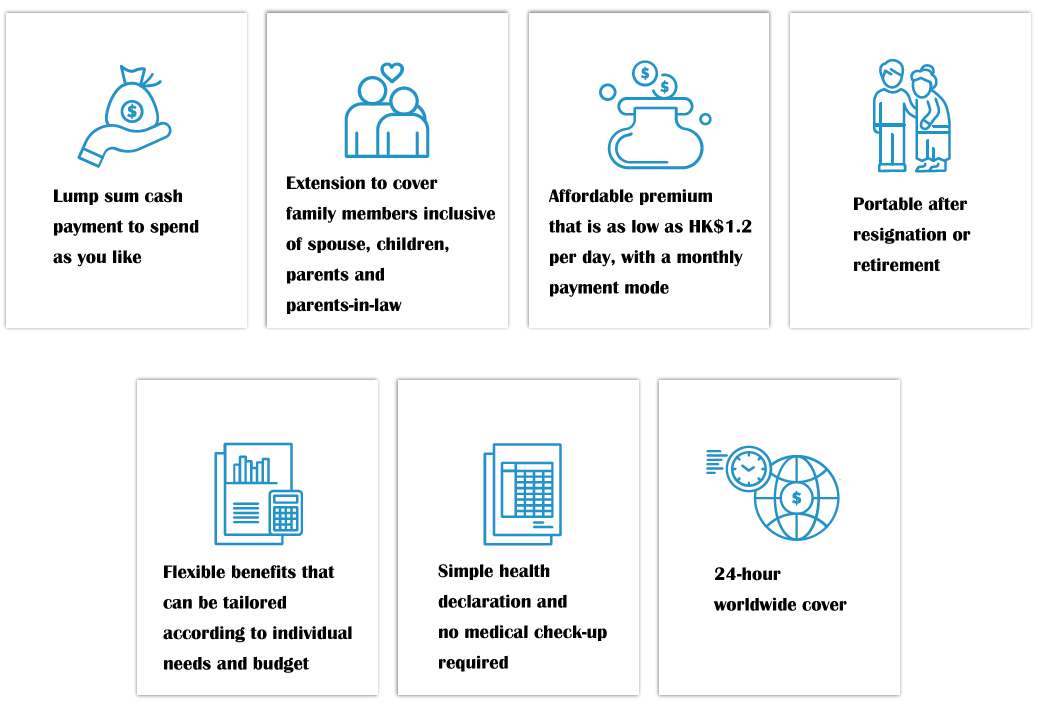

Voluntary Employee Benefit

Now more than ever, employees are anxious to protect themselves and their families from unforeseeable events.

In addition to covering medical bills, employees are seeking further financial protection against loss of income or other non-medical expenses. Appointed by your employer as an employee benefits provider,

The insurers offer Voluntary Employee Benefits Program that includes supplemental health insurance options as Personal Accident, Critical Illness and Daily Hospital Income cover in one convenient plan.

This program helps to fill the gap in traditional medical benefits coverage and provides employees with peace of mind.

Get A Free Quote - MPF

Your Trusted Partner

In addition to providing life insurance services, Hantec also has MPF specialists who provide consultation, quotation and claims handling services to our customers.

MPF

Product Recommendations

Any employer, employee, self-employed person, individual or company account opener can participate.

Tax Voluntary Contribution Account (TVC) TVC is a new type of MPF contributions and can only be paid into a TVC account of an MPF scheme which may enjoy tax concession. It is, by nature a voluntary contribution, made directly by members to an MPF scheme without the involvement of their employers.

As it is different from other type of voluntary contributions which may be allowed to be withdrawn relatively flexibly, TVC, in order for it to enjoy the tax concession, is subject to the same vesting, preservation and withdrawal restrictions applicable to mandatory contributions.

Accordingly, any monies paid as TVC can only be withdrawn upon retirement at age 65 or other statutory grounds under the MPF legislation.

Whether it is for resigned or newly recruited colleagues, remember to integrate your Mandatory Provident Fund (MPF) account! Easy to manage.

Contributors retire at the age of 65 or file a claim for withdrawal of MPF under other statutory grounds under the MPF Act.

Employee Choice Arrangement commonly known as "MPF Semi-Freedom", employees can choose to transfer the MPF accrued from the employee's mandatory contributions in the contribution account to the MPF scheme of their choice once a year.

Give employees greater autonomy in choosing trustees and MPF schemes

Get A Free Quote - Incorporated Owner’s Insurance

Your Trusted Partner

Hantec provides specialists to provide corporate clients consultation, quotation, claims services, etc.

Incorporated Owner’s Insurance

Product Recommendations

Incorporated Owner’s Insurance

Pursuant to section 28 of the amended Building Management Ordinance (Cap. 344), from 1 January 2011, all corporations are required to take out and maintain in force third party risks insurance in respect of the common parts of the relevant buildings and the property of the corporation.

The single accident insured amount for each policy for bodily injury or death of a third party shall not be less than HK$10 million. We recommend that corporations that have taken out third party risk insurance should ensure that they enjoy insurance protection that complies with the insurance requirements of the relevant regulations and that the coverage amount is sufficient.

In this way, if an accident unfortunately occurs in the public areas of the building, resulting in accidental injury or death of a third party, the amount of compensation may be very large, and the relevant insurance can ease the financial burden of the owners' corporation and individual owners.

Although this is a statutory insurance, like other insurances, it does not cover legal liabilities arising from illegal structures or unauthorized building works in the building.

Latest News

Contact us

We would gladly answer any question you may have